The Recent Crash of Bitcoin: Understanding the Numbers

In a recent turn of events, Bitcoin’s price has dropped significantly, nearing the cost basis of Strategy, the company led by Michael Saylor that holds nearly half a million bitcoins. This decline is raising eyebrows as the digital currency approaches a pivotal financial milestone that could foreshadow larger implications for cryptocurrency investors.

The Cost Basis Puzzle and Market Dynamics

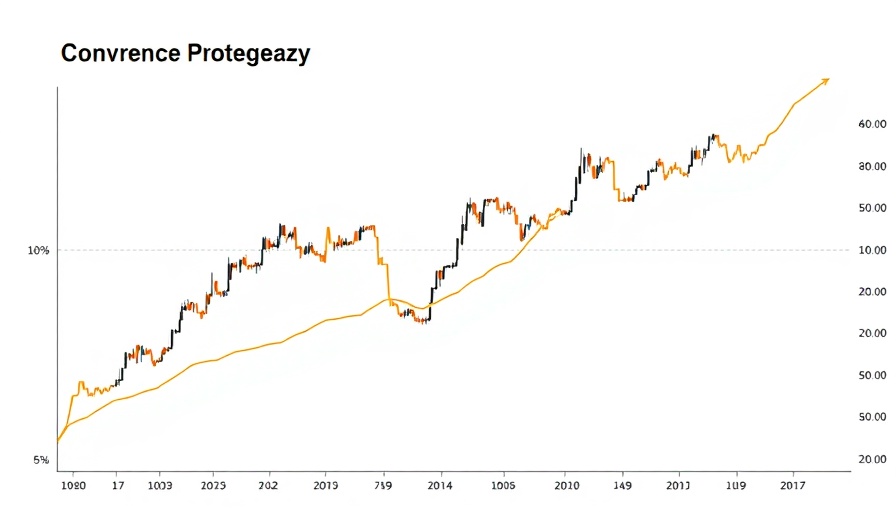

Strategy's average cost for acquiring Bitcoin stands at $66,360 per coin. Yet, the current market price is hovering around $84,500, placing a slender 27% gap between the two figures. This disparity has shrunk dramatically from previous periods where Bitcoin traded at over 73% above the company's purchase price, especially evident during key market events like the inauguration of Donald Trump.

For instance, Bitcoin peaked at $108,786 shortly after the inauguration, creating what many investors labeled a 'comfortable cushion.' However, the trend has turned as Bitcoin's prices have dropped substantially since those highs, creating new challenges for Saylor and his strategy.

A Closer Look at Corporate Bitcoin Holdings

The recent downturn has left many wondering about the implications for Strategy’s substantial Bitcoin holdings, currently valued at $43 billion. As reported, the firm has acquired its Bitcoin at different times, with many investments since mid-2024 being made at prices above the current trading price. This raises questions about whether forced liquidations of assets might occur if Bitcoin’s price were to plummet further.

With a considerable amount of the company’s assets tied up in Bitcoin, its trajectory could significantly impact the future operations and financial health of Strategy. Investors must pay keen attention to this situation, as any further declines in Bitcoin could trigger strategic decisions from corporate leaders.

The Consequences of a Sinking Market

The ongoing crash of Bitcoin leads to a bigger question for many—the fate of Saylor's visionary plans for further BTC acquisitions. Although he has indicated an interest to purchase $21 billion worth of Bitcoin, actions speak louder than words, and recent market changes will likely dictate the company's moves moving forward.

As Strategy tries to navigate through these turbulent waters, it’s essential for potential investors to remain informed about the broader implications of any major moves from Bitcoin's leading corporate holders. The narrative surrounding Bitcoin is far from static; it evolves with each market fluctuation and investor sentiment.

It’s important to be proactive in the crypto market. For those looking to deepen their understanding in this unpredictable landscape, explore insightful analysis and tips on smart investing strategies in cryptocurrency.

Add Row

Add Row  Add

Add

Write A Comment