Bitcoin Surges Amid Institutional Investment

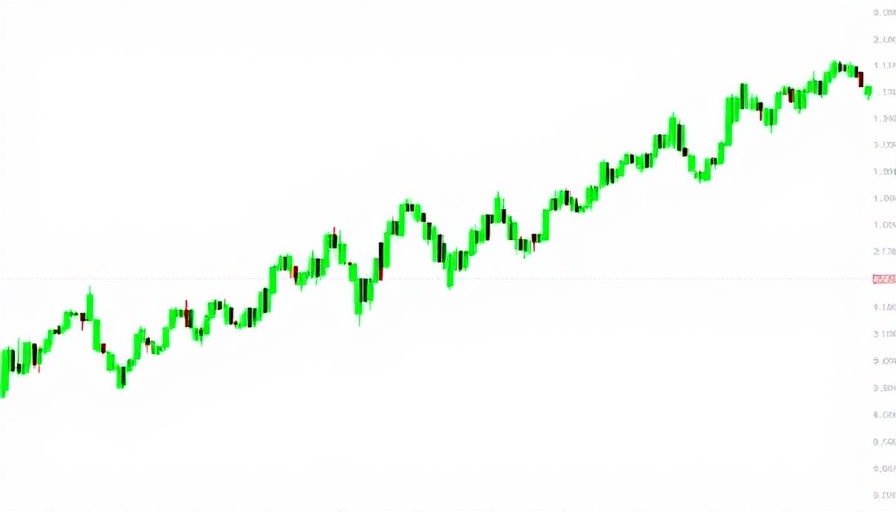

Bitcoin’s recent upward trajectory saw it reach the impressive price of $85,000, sparking tremendous interest in the cryptocurrency market. This surge in value can largely be attributed to significant institutional investments from notable players like Tether and Japanese firm Metaplanet. Tether purchased a whopping 8,888 BTC, boosting its total holdings to around $7.8 billion, while Metaplanet added 696 BTC to its coffers, now owning 4,046 BTC in total. This growing corporate interest reflects a broader trend of viewing bitcoin as a treasury asset, effectively driving demand and supporting its price stability.

The Impact of Tariff Speculation on Bitcoin Pricing

The excitement around Bitcoin’s rally coincides with anticipation surrounding President Trump’s upcoming tariff announcement, dubbed “Liberation Day.” Speculation suggests that the proposed tariffs may not be as draconian as initially feared, which has helped bolster investor confidence. Statements from White House Press Secretary Karoline Leavitt indicated awareness of market concerns, acknowledging valid worries related to the tariff discussions. This openness potentially alleviated fears and propelled not only Bitcoin but also other cryptocurrencies and tech stocks into positive territory, demonstrating the intricate connections between economic policy and market reactions.

Market Reactions and Investor Sentiment

As Bitcoin gained, so did interest across the crypto spectrum, with Ethereum (ETH), Dogecoin (DOGE), and Cardano (ADA) experiencing comparable increases of roughly 4-5%. The bullish sentiment in the crypto market prompted strong performances in crypto-related stocks, particularly among mining companies like Core Scientific and CleanSpark, which saw gains of nearly 10%. The aspect of short liquidations also painted a vivid picture: bears betting against Bitcoin's rise faced significant losses amounting to $25.19 million in just 24 hours, highlighting an enthusiastic shift in market sentiment around this asset.

Grassroots Impact: Bitcoin in Local Communities

As Bitcoin price excitement spreads, it’s important to note the human stories that often surface from these financial movements. Community investors are often finding their footing in the cryptocurrency arena, seeing it as a viable avenue for growth and support. As local narratives emerge, grassroots initiatives tied to cryptocurrency education and investment clubs pop up, establishing a shared dialogue about financial literacy and opportunity in the digital age.

With Bitcoin’s climbing price, fueled by institutional interest and an optimistic economic outlook, the cryptocurrency world continues to evolve. Whether you are a seasoned investor or someone considering entering this digital currency realm, keeping an eye on market movements can be key to making informed decisions about your financial future.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment