The Rise of Ethereum: Breaking Through the $4,000 Barrier

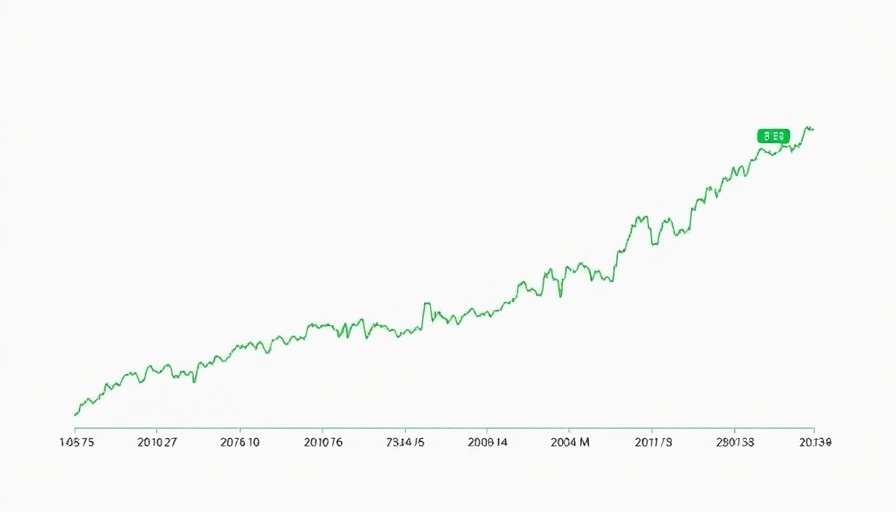

The cryptocurrency market is buzzing with excitement over Ethereum (ETH) as it trades at a notable $3,745, propelled by a remarkable 65% surge since June. With growing institutional demand and significant inflows into spot funds, ETH is inching closer to its next major milestone: the critical $4,000 resistance level.

Institutional Investors Take Notice

July was a standout month for Ethereum, recording an impressive $3.28 billion in net inflows. This demonstrates a shift in interest from speculative trading towards viewing Ethereum as a viable treasury asset for companies. Various firms, such as BitMine, have ramped up their ETH purchases considerably, with the latter holding around 300,000 tokens. Notably, billionaire investor Peter Thiel's recent acquisition of a 9.1% stake in BitMine provides substantial indirect exposure to these ETH holdings, signaling confidence in Ethereum's long-term potential.

Whale Activity and Price Pressure

Recent transactions reveal intense whale activity in the Ethereum space. A major investor's purchase of 122,000 ETH within just one week illustrates the demand from large players who are keen to accumulate and reduce circulating supply. Such behaviors not only influence market dynamics but also exert upward pressure on Ethereum's price, positioning it just 6.8% away from that significant psychological barrier of $4,000.

Optimism in Regulatory Changes

The regulatory environment surrounding cryptocurrency has also improved markedly. New legislation like the GENIUS Act provides a framework that favors the growth of digital assets, clearing hurdles that have previously complicated Ethereum's trajectory. Traders are especially eager for any announcements from the SEC on approving staking ETFs—such a move could ignite further upward momentum.

Market Dynamics: A Shift from Bitcoin to Ethereum

Interesting market dynamics are unfolding as Bitcoin's dominance falls from 66% to 61%. This rotation suggests a growing appetite for alternative cryptocurrencies like Ethereum. With many investors looking for diversified opportunities, Ethereum's increasing adoption could soon lead to fresh highs, particularly as it strives to breach that iconic $4,000 mark. The blend of institutional interest, whale accumulation, and favorable regulations may just create the perfect storm for Ethereum to reach new heights.

Add Row

Add Row  Add

Add

Write A Comment