The New Wave of Trading Insights

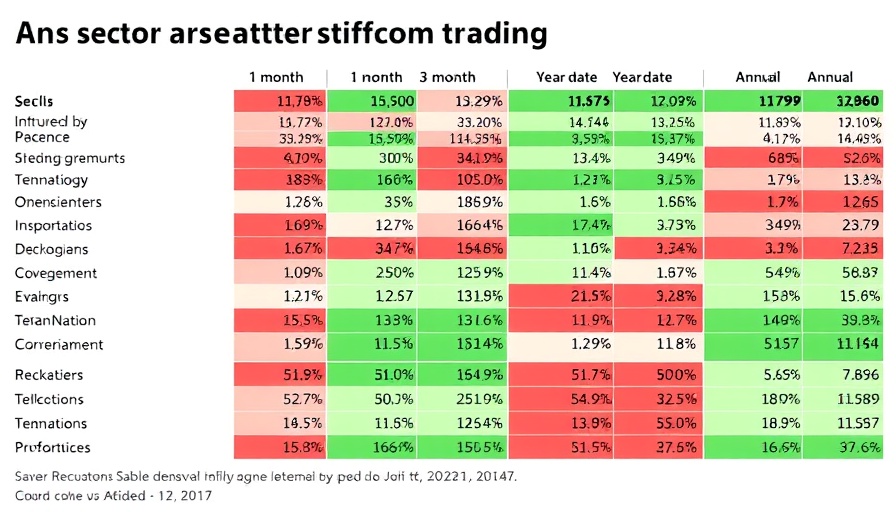

In the dynamic landscape of the stock market, understanding where money flows is crucial. Recent reports highlight significant sector shifts that can guide investors in making informed decisions. In a span of just thirty days, sectors like Information Technology and Communication Services have surged, showcasing increases of 11.31% and 8.93% respectively. This contrasts sharply against the S&P 500, which only saw a rise of 6.19%. Without diving deeper into these numbers, traders risk being misled by average figures that don't represent the true potential of their investments.

Key Sector Insights: Win or Lose

Analyzing the current performance data serves as a cheat sheet for traders. It reveals the winners and losers among sectors—while names like Healthcare and Real Estate are floundering, tech and discretionary sectors are thriving. This information is not just a snapshot; it reflects the ongoing shift in institutional capital. Understanding these dynamics is necessary for traders looking to position themselves advantageously.

Decoding the Market: The Emotional Right Way

Many traders fall into the trap of chasing headlines or clinging to outdated trends, ultimately jeopardizing their investments. This could lead to significant losses, especially in a time when sectors are rapidly evolving. Instead, leveraging technology like dual-patented AI that scans every sector can offer insights before major market movements occur. Such tools eliminate the guessing game and equip traders with data-driven strategies for navigating the volatile market landscape.

Charting Your Course in 2025

In 2025 and beyond, being proactive is essential. The performance gap between thriving and struggling sectors won't narrow by itself; traders need to adapt, pivot, and refine their methods. Keeping a pulse on noteworthy sector performance enables individuals to steer clear of "dead weight" investments while capitalizing on growth opportunities. As momentum builds in sectors like technology and consumer discretionary, active engagement and using advanced tools can significantly enhance one's trading outcomes.

Ultimately, the call to action for both experienced and novice traders is clear: stay informed, stay adaptive, and utilize the best tools available to make strategic decisions.

Add Row

Add Row  Add

Add

Write A Comment